According to a recent UNICEF report, at least 23 countries guarantee a minimum income for families with children. Many of the children whose families were excluded from the original CTC were the children of single parents, Black and Hispanic children, and children who live in rural areas.Įffectively, parents who receive the CTC under the Rescue Plan are getting a small taste of what it would be like to have a guaranteed minimum income to support their children. Before the legislation, the poorest 10% of children did not receive any benefit from the CTC and about 25% received only a partial benefit. The plan’s CTC is fully refundable, such that it will benefit 93% of the parents of American children, or 69 million people. The plan’s newly liberalized child tax credit (CTC), which is a cash transfer that can be spent as parents and caregivers determine, has been receiving a lot of media coverage because of its transformational potential. Payments in support of children have appreciably reduced child poverty in real time, but have also produced more benefits. So we need to make sure that families and communities on the ground are aware of this program, and we need to work aggressively to get them signed up.” However, as the Children’s Defense Fund’s Director of Poverty Policy, Emma Mehrabi, cautions, “Th data will only live up to its projections if families-especially the hardest to reach-know about the benefits and can easily access them. The poverty rate for Black, Hispanic, and Indigenous children, who are disproportionately affected by both poverty and COVID-19, would decline by 52%, 45% and 61% percent, respectively. The Center on Social Policy at Columbia University has estimated that the American Rescue Plan will cut the child poverty rate by as much as 56% this year, which would affect children of all races. These legislative provisions could have a profound impact on the landscape of American poverty, particularly child poverty, after more than a year of an unprecedented health crisis. Greater ease in accessing EBT funds for school-age children during public health emergencies.Increases in both SNAP and WIC benefits to enable more household food purchases.An expanded tax credit worth up to $3,600 for every child under age 6, and $3,000 for children between 6 and 17, to be paid out over the course of 2021.

#Growing up poor in america free

This included taking her to get free lunches for school-age kids at McDonald’s. Shawn tried his best to help at home as a so-called “brother-father” to his younger sibling.

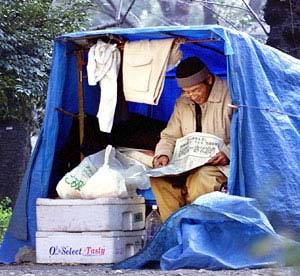

Shawn’s mother had been diagnosed with kidney disease, yet still had to risk exposing herself to COVID-19 by “working off” hours required to receive her benefits at the local Salvation Army. In the Frontline documentary “Growing Up Poor in America,” 13-year old Ohioan Shawn and his mother and baby sister were subsisting on $885 a month in benefits during the early days of the pandemic-half in food stamps and half in rent assistance for their trailer.

0 kommentar(er)

0 kommentar(er)